Get approved for a mortgage refinance in 60 Seconds

Instant

online

approval

24 Hours

to process the

paperwork

Lowest

interest rates available in GTA

Avoid

mortgage breaking penalties!

Save on a mortgage refinance with rates starting at

You may recognize Cannect and the team from

APPLY ONLINE

60 seconds

GET QUOTE

Instantly

OBTAIN MONEY

24 hour processing

When the banks won’t help you, we will

Breaking your current mortgage often leads to big penalties, however we can help you avoid or minimise these fees and literally save an average of $20,000 to $30,000.

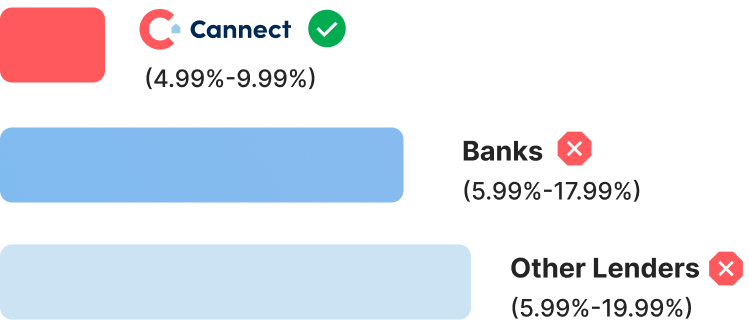

Lowest Interest rates

As of April 2023

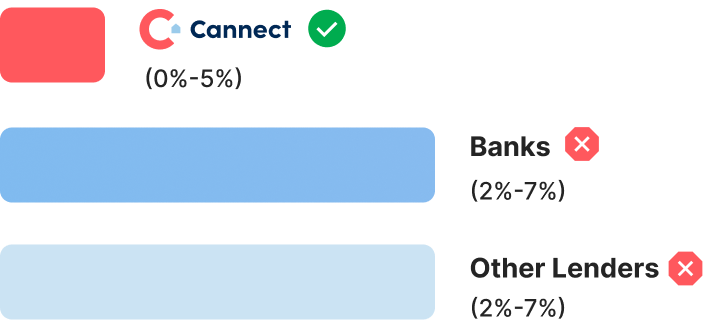

Loan Processing Fee

Lawyer Fee

Home Appraisal (Not Required)

$0 – $1,500

Other Lenders

Banks

We've been helping Canadians save with mortgage refinancing since 2002.

Why go with Cannect?

Lower Cost

When choosing Cannect, you work directly with us as opposed to a middleman that needs to increase costs at every step. This means you save on the initial loan fees (legal and processing), and are spared the extra markups of a go-between broker.

Toronto’s lowest interest rates

We've developed one of the industry's most powerful loan cost simulators to determine your actual loan costs based on real-time market data. This allows us to virtually guarantee the lowest interest rates in the greater Toronto area, at any given time.

Long-Term Debt Reduction

Unlike most lending firms, our team is non commissioned, so we have no incentive to lock you up into a higher-rate loan. Our goal is to help you solve short-term cash flow problems, boost your credit score, and then transition you to a lower-cost alternative that will reduce your debt in the long run.

Super Fast turnaround

We get that you have mounting pressures and possibly overdue bills to pay, yesterday. That's why we prioritise same-day responses to your inquiries and ensure funds can be transferred to you in days, not weeks. And this is without leaving your home.

Testimonials

Angela has been invested in the Cannect Mortgage Investment Corporation since 2013. Find out what she thinks of her investment. “Cannect is a very specialized investment. I

Alessandra is a professional real estate lawyer and owner of Vantage Law. She is invested in the Cannect Mortgage Investment Corporation. “The reason why I

Bruce is a professional Search Engine Optimizer, and an investor in the Cannect Mortgage Investment Corporation. Take a listen to his video testimonial on Cannect. “The

Ola is a technical consultant with a major telecommunication company and an investor in the Cannect Mortgage Investment Corporation. Take a minute to hear her story

Kris and Christine are some of the very first investors in the Cannect Mortgage Investment Corporation. With 10 years of investments within the fund, they break