Facing mortgage rates 3x higher than before? Cannect is here to help!

Can a boring investment yield a high return?

With over -- in annualized returns* since our inception in March 2013, the Cannect Mortgage Investment Corporation is one of the best investments* you can make today.

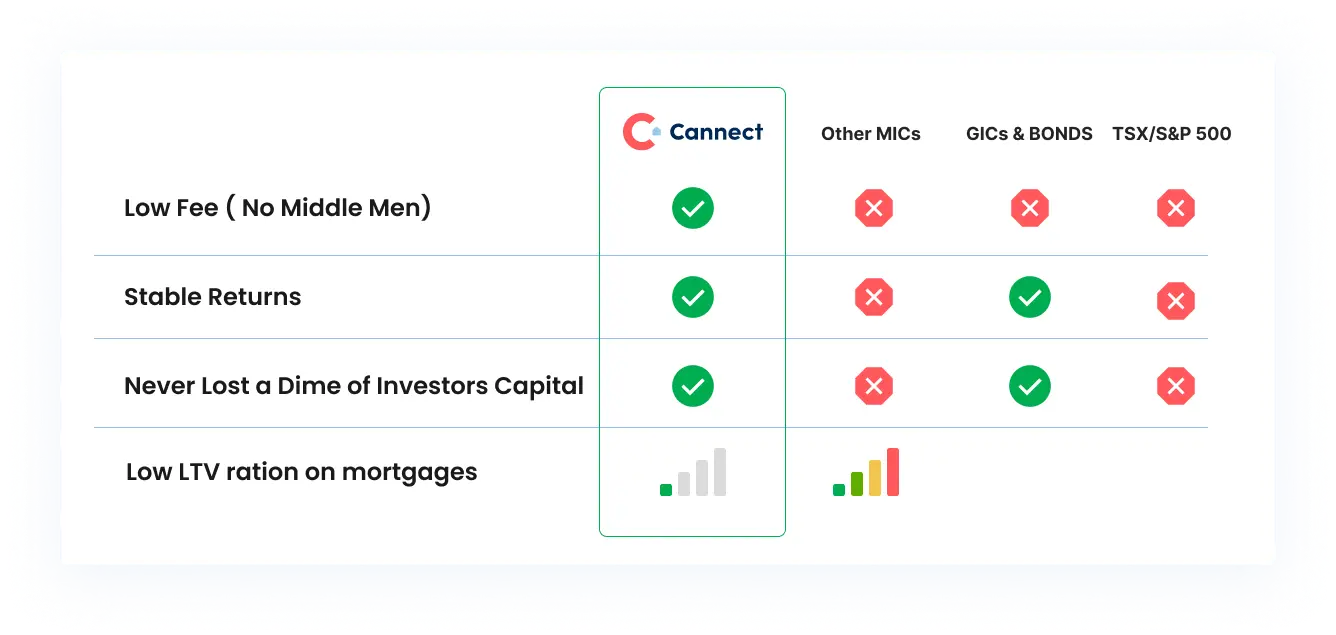

Why choose Cannect Mortgage Investment?

Lower fees, no middlemen

Unbiased guidance from non-commissioned staff

High returns compared to fixed income investments

Lowest Loan To Value Mortgages in the industry

What’s the process?

A step-by-step guide to mortgage renewal with Cannect

1. Apply online

Fill the form above to open the application. Apply online in under 60 seconds and start your home refinancing journey.

2. Submit documents

Upload your ID and supporting documents which include

1.Identification.

2.Proof of employment and income.

3.Details regarding your assets, savings and debts.

4.Tax documents.

we will check your credit ability, during the process you can always reach out to our agents for help.

More details : Call 416.766.9000

Note:

We have given our investors a consistent return of around 10%, which is much less risky than the capital markets and more than your safe traditional banks

3. Open MIC investment account

We have a fast 24 Hr processing, our agents will have a free consultation with you to speed up the process.

4. Investing Funds

This is where all the last documents get signed, and the funds are transferred, now you can relax in peace at your home, when your money works for you.

* Audited results as of May 2023. Past returns are not indicative of future results, please request a copy of our Offering Memorandum for more details.

Award-winning, because we actually care.

Boring & safe by design

Low Loan-to-Value (LTV) Ratio

Minimal risk is built-in by design, with a low LTV ratio of 50 to 60% —much lower than the major banks. We also only lend when a borrower has a credible 6- to 12-month exit strategy.

Full Transparency with Investors

You always have direct access to the Cannect MIC portal, which provides real-time information about all properties held in the portfolio, selection criteria, appraisals, exit strategies and returns.

Consistently High Returns

Technology makes us a better lender. For you, that means a better investment.

Never Lost a Dime of Investors Capital

Cannect as a reliable leader in wealth preservation and enhancement. Investors can trust in the company's ability to identify lucrative opportunities, mitigate risks, and deliver steady, reliable growth, making Cannect a standout choice in the competitive landscape of mortgage investments.

Have more Questions?

We have all the answers for you

More details, call: 416.766.9000

What is the Cannect Mortgage Investment Corporation (MIC)?

Cannect MIC is a Mortgage Investment Corporation that allows individuals to invest in a diversified portfolio of secured Canadian residential mortgages. By pooling investor capital, Cannect MIC provides stable, consistent monthly returns with lower risk, backed by real estate. It’s an ideal option for those seeking passive income, RRSP/TFSA-eligible investments, and greater transparency in how their money is being used.

How much can I earn by investing with Cannect?

Cannect MIC has delivered consistent returns, with current annual yields averaging around 8.14% (based on a 12-month trailing average). Returns are distributed monthly, and investors benefit from a steady stream of income. While past performance isn’t a guarantee of future results, Cannect prioritizes stability and transparency to help investors earn more with confidence.

Is my investment safe with Cannect?

At Cannect, protecting your investment is our top priority. All mortgages in our portfolio are secured by real estate, and our lending process is conservative, focusing on low loan-to-value ratios and strong borrower profiles. We also invest alongside our clients, which means our interests are fully aligned with yours. Our track record and commitment to risk management help ensure long-term stability and performance.

Can I invest using my RRSP, TFSA, or other registered accounts?

Yes! You can invest in Cannect MIC through registered accounts such as RRSP, TFSA, RRIF, and RESP. We work with a range of trustee partners to make the process simple and efficient. This allows you to grow your investment tax-deferred or tax-free, depending on the account type, while earning steady monthly returns.

Testimonials

Angela has been invested in the Cannect Mortgage Investment Corporation since 2013. Find out what she thinks of her investment. “Cannect is a very specialized investment. I

Alessandra is a professional real estate lawyer and owner of Vantage Law. She is invested in the Cannect Mortgage Investment Corporation. “The reason why I

Bruce is a professional Search Engine Optimizer, and an investor in the Cannect Mortgage Investment Corporation. Take a listen to his video testimonial on Cannect. “The

Ola is a technical consultant with a major telecommunication company and an investor in the Cannect Mortgage Investment Corporation. Take a minute to hear her story

Kris and Christine are some of the very first investors in the Cannect Mortgage Investment Corporation. With 10 years of investments within the fund, they break

Purchasing dream home with Cannect

“Embark on your dream home journey with Cannect – where dreams meet reality. Benefit from our lowest interest rates, experience a fully automated process, and enjoy complete transparency with no hidden charges or brokerage fees. Your dream home is within reach, and Cannect is here to make it a seamless and affordable reality.”