Call for help or get a quote:

Get approved for a mortgage refinance in

Check our rates,

Save thousands of dollars with Cannect

Fixed From

Variable From

Why choose Cannect for refinancing?

Instant Online Approval

Full process completes in just 24 Hours

The lowest interest rates available in GTA

Helps avoid Mortgage Breaking penalties

When the banks won’t help you, we will

Breaking your current mortgage often leads to big penalties, however we can help you avoid or minimise these fees and literally save an average of $20,000 to $30,000.

It’s your equity. There’s nothing stopping you from using it to pay for a vacation, a new boat or something else on your wish list. Just make sure there aren’t any cheaper, easier ways of paying for these items before moving forward with a mortgage refinance.

Let’s Start, Just 3 Quick Steps to lower your interest rates.

Reasons to refinance a mortgage

Testimonials

Alessandra is a professional real estate lawyer and owner of Vantage Law. She is invested in the Cannect Mortgage Investment Corporation. “The reason why I

Bruce is a professional Search Engine Optimizer, and an investor in the Cannect Mortgage Investment Corporation. Take a listen to his video testimonial on Cannect. “The

Ola is a technical consultant with a major telecommunication company and an investor in the Cannect Mortgage Investment Corporation. Take a minute to hear her story

We've been helping Canadians save

with mortgage refinancing since 2002.

Why go with Cannect?

Lower Cost

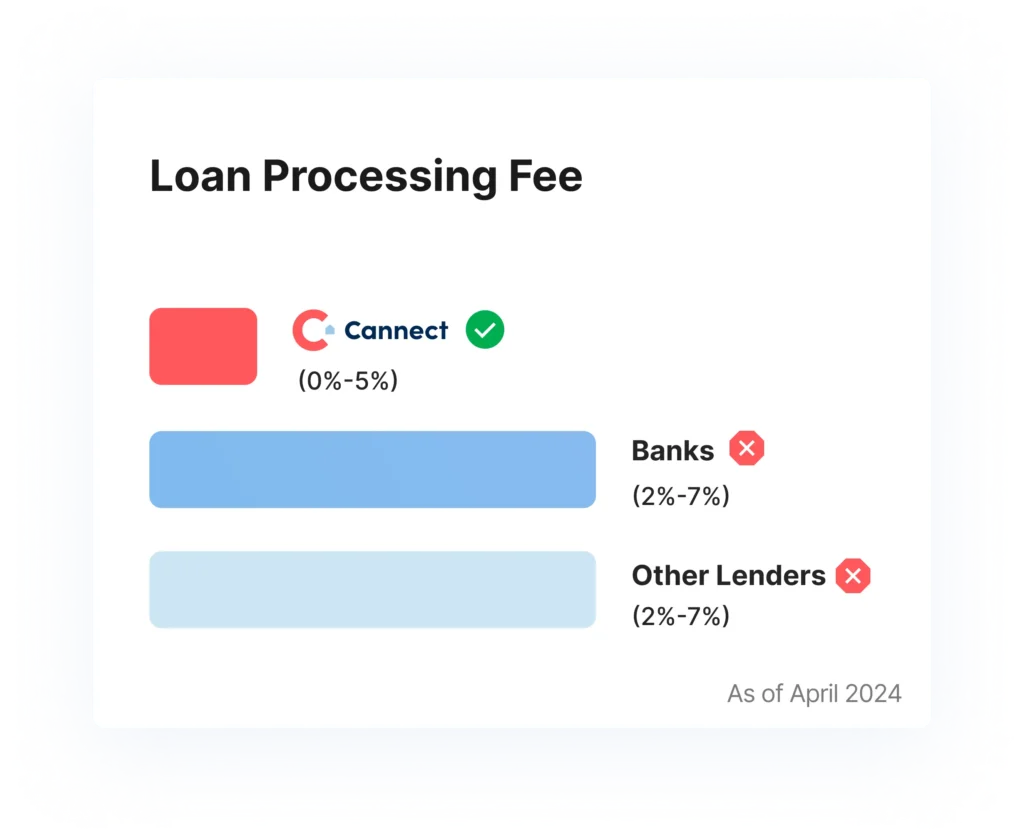

When you choose Cannect, you work directly with us instead of going through a middleman who adds extra costs at every step. This means you save on the initial loan fees (legal and processing), and are spared the extra markups of a go-between broker.

Toronto’s lowest interest rates

We've developed one of the industry's most powerful loan cost simulators to determine your actual loan costs based on real-time market data. This allows us to virtually guarantee the lowest interest rates in the greater Toronto area, at any given time.

Long-Term Debt Reduction

Unlike most lending firms, our team is non commissioned, so we have no incentive to lock you up into a higher-rate loan. Our goal is to help you solve short-term cash flow problems, boost your credit score, and then transition you to a lower-cost alternative that will reduce your debt in the long run.

Super Fast turnaround

We get that you have mounting pressures and possibly overdue bills to pay, yesterday. That's why we prioritise same-day responses to your inquiries and ensure funds can be transferred to you in days, not weeks. And this is without leaving your home.

Have more Questions?

We have all the answers for you

How much can you borrow?

Your new mortgage amount depends on how much your home is worth. When refinancing, you can usually borrow up to 80% of your home’s value. But keep in mind, part of that goes to pay off your current mortgage. The leftover money is yours to use as you wish.

For instance, if your home is valued at $100,000, you could refinance for up to $80,000 (80% of $100,000). But if you still owe $75,000 on your current mortgage, you’ll have access to $5,000 ($80,000 – $75,000) for anything you need. Simplify your finances with a smarter mortgage approach.

What is the cost of a mortgage refinance?

While refinancing incurs fees, the potential benefits often outweigh these costs. The total expenses vary based on your unique situation and reasons for refinancing. Here’s a detailed breakdown of the associated costs when refinancing your mortgage in Canada:

Mortgage Refinancing Costs Overview

Penalty Break term early: Typically around $1000 minimum, based on the highest of either 3 months’ interest or IRD (Interest Rate Differential).* *Blend and extend mortgages do not incur a prepayment penalty.

Refinance at Renewal: None

Mortgage Discharge Fee Covers administrative costs for closing your existing mortgage. $200-300 (or $0 if staying with the same lender)

Mortgage Registration Fee Covers the cost of registering the new mortgage. Varies by province, typically $50-150

Home Appraisal Assessment of your property’s value by a professional appraiser. $300 – 500

Legal Fees Covers legal documentation and processing. $750 – 1500

When to refinance your mortgage?

Refinancing becomes attractive when interest rates decline, presenting an opportunity to secure a lower mortgage rate. This scenario is especially compelling if you require extra funds. By obtaining a reduced mortgage rate, you could potentially enjoy substantially reduced monthly payments.

At Cannect, we excel in mortgage renewals, ensuring our customers benefit from the best rates available in the market. When considering refinancing, trust Cannect to guide you through the process and secure optimal terms tailored to your financial goals.

What documents do I need to refinance my mortgage?

Once you’re approved for a loan online, you will be contacted by a member of our team and asked to upload identification, proof of property ownership and existing mortgage information. A Cannect lawyer will confirm your information within the hour and proceed with a transfer of funds, which you receive in 24 hours or less.

Make Money Count Podcast

Our podcast will give you more insight to Cannect

Marcus and Justin provide a comprehensive overview of the current economic conditions in the Canadian real estate market. Highlighting the absence of a spring market

In this episode of the Make Money Count podcast, Marcus is joined by his long-time co-host Justin Turner to discuss the advantages of variable rate

In this week’s riveting episode of Make Money Count, Marcus delves into the pressing economic questions surrounding housing crisis predictions and the underlying factors contributing

Mortgage refinancing with Cannect

“Refinancing with Cannect is not just about adjusting your mortgage; it’s an opportunity to review and align your financial plan, with new terms such as interest rates varying based on the market and your finances, and if you have any concerns, Cannect prioritizes clear communication to find solutions while saving you thousands of dollars, but it’s important to note that refinancing too early can result in extra charges, so timing is crucial, and if you have questions or need guidance, Cannect experts are here to help, let Cannect be your partner in financial growth, simplifying the mortgage refinancing process for a stronger financial future.”

Marcus Tzaferis

Founder Cannect Inc.