Get approved for a Home Equity Loan in 60 Seconds

- Instant online approval

- 24 hours to obtain money transfer

- Lowest interest rates available in GTA

- Less fees — we cut out the middleman!

Get funds in 24 hours without leaving your home

When the banks won't help you, we will.

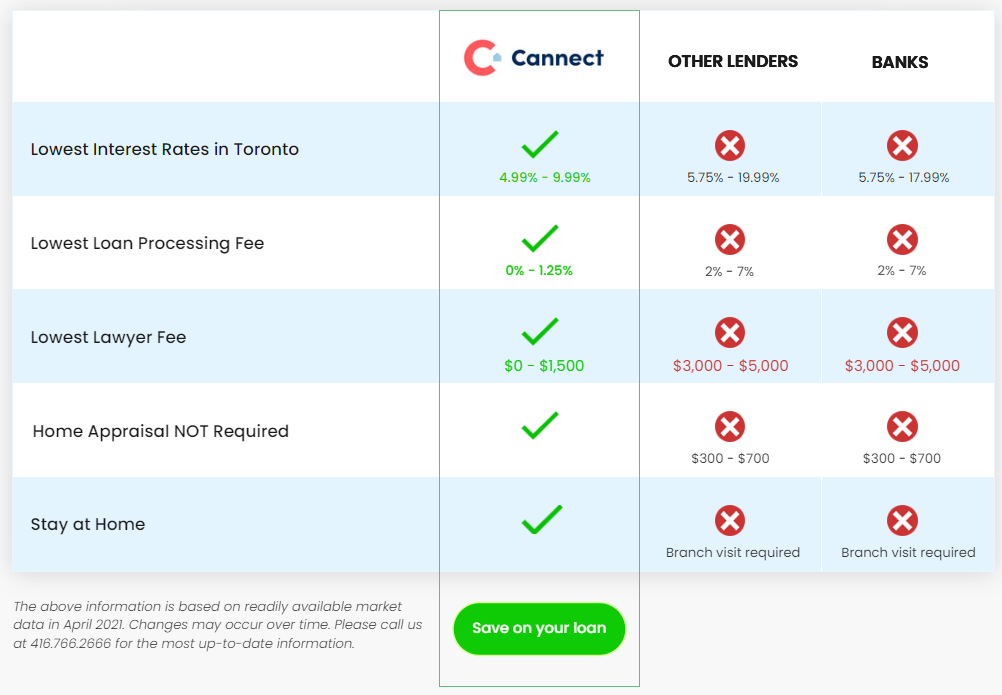

How you save with Cannect

Award-winning, because we actually care.

Independent Lender

of experience

Why go with Cannect ?

LOWER COSTS

When choosing Cannect, you work directly with us as opposed to a middleman that needs to increase costs at every step. This means you save on the initial loan fees (legal and processing), and are spared the extra costs of a home appraisal and go-between broker.

TORONTO'S LOWEST INTEREST RATES

We've developed one of the industry's most powerful loan cost simulators to determine your actual loan costs based on real-time market data. This allows us to virtually guarantee the lowest interest rates in the greater Toronto area, at any given time.

LOWER COSTS

When choosing Cannect, you work directly with us as opposed to a middleman that needs to increase costs at every step. This means you save on the initial loan fees (legal and processing), and are spared the extra costs of a home appraisal and go-between broker.

TORONTO'S LOWEST INTEREST RATES

We've developed one of the industry's most powerful loan cost simulators to determine your actual loan costs based on real-time market data. This allows us to virtually guarantee the lowest interest rates in the greater Toronto area, at any given time.