Get Canada's best rates in just 60 seconds, funded in

24 hours without leaving your home.

No credit check,

No issues

No surprises,

No Hidden Costs

Lowest rate,

Regardless of credit

No Middle Men,

Unbiased expert advice

5 Star Google Reviews

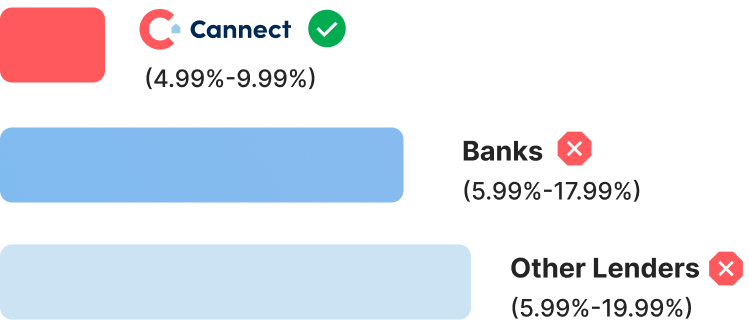

Lowest Interest rates

As of April 2023

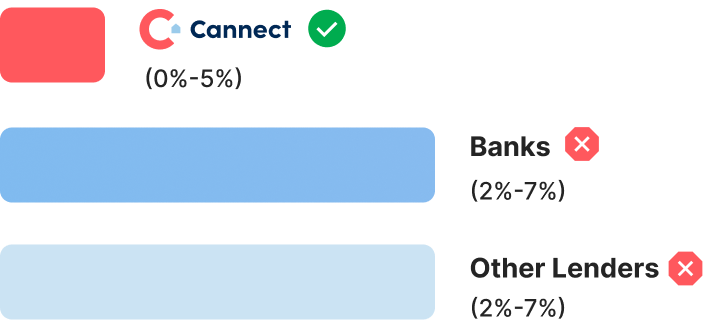

Loan Processing Fee

Lawyer Fee

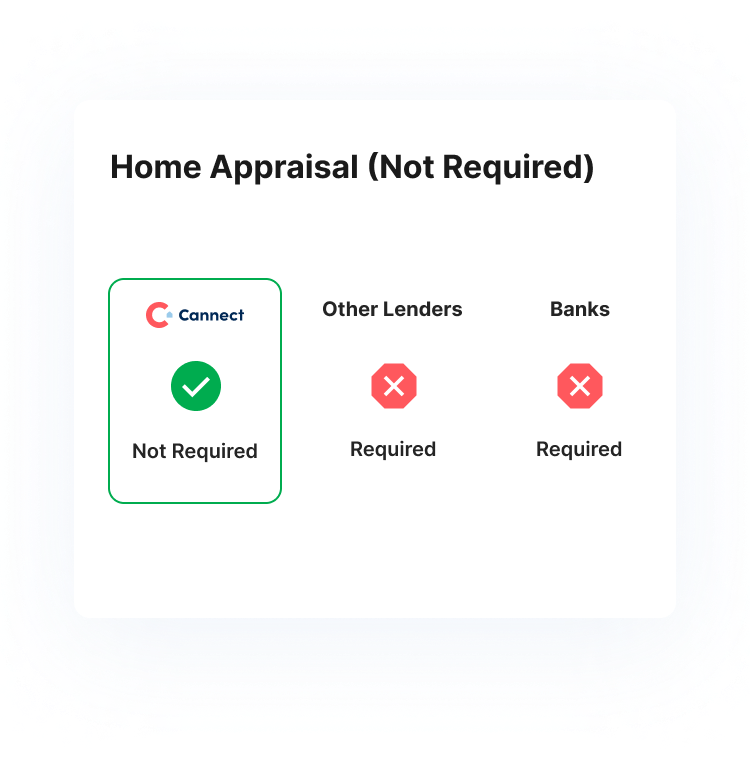

Home Appraisal (Not Required)

$0 – $1,500

Other Lenders

Banks

You may recognize Cannect and the team from

Home financing news

Find the latest home equity and mortgage financing news on the Cannect blog.

Buying a home is a major financial undertaking, and it’s no surprise that it’s easy to become overwhelmed....

OSFI – the regulator of all Canadian Financial Institutions has imposed underwriting guidelines for Residential Mortgages on all...

A fast, short-term personal loan (also known as a bridge loan or bad credit loan) that is based on your home’s equity. It’s designed to help you get back on your feet, consolidate your debts and transition to a better financial situation.

No. Unlike banks, we do not require you to be currently employed, nor do you need a good credit score.

Once you’re approved for a loan online, you will be contacted by a member of our team and asked to upload identification, proof of property ownership and existing mortgage information. A Cannect lawyer will confirm your information within the hour and proceed with a transfer of funds, which you receive in 24 hours or less.

Many people now find now themselves without income or between jobs, so they need liquidity to pay off short-term debt, credit cards and general expenses. Other people use this as a debt consolidation loan to reduce their debt over the long-run, which typically helps build up their credit score. Using the loan to perform home renovations is also a common strategy, as the increase in profit on your home sale usually more than offsets the cost of the loan.