Find your perfect mortgage match with Cannect!

Cannect Home Equity Loans turn your home’s value into the financial freedom you deserve. Fast, reliable, and tailored for you.

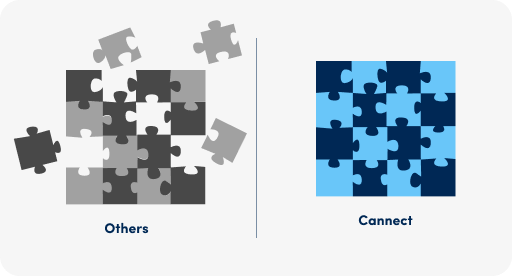

Here’s Why Cannect Is Canada’s Top Independent Mortgage Source:

With over $6 billion in mortgages funded and over two decades of expertise, Cannect is redefining how Canadians borrow — helping homeowners save more and stress less. We get it: no two financial journeys are the same, which is why our tailored solutions are designed with you in mind. Unlike banks, our salaried mortgage experts prioritize your financial future — not shareholder profits.

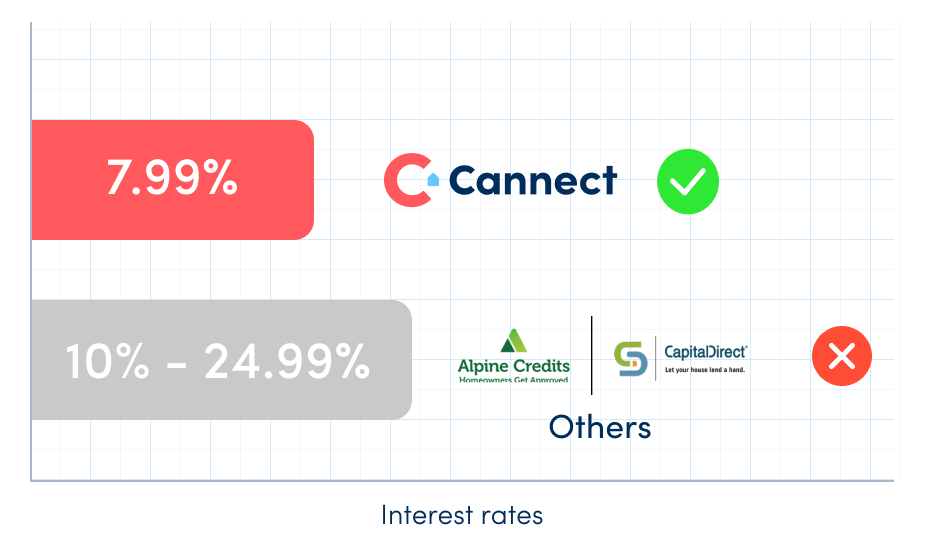

Lowest Rates Guaranteed

You deserve the best rate, and we get you your lowest rate, no matter what.

A Track Record You Can Trust:

With over 50,000 satisfied clients and a 4.9-star Google rating, our track record speaks for itself.

Flexible Loan Options:

With Cannect, you can consolidate high-interest debts, fund home upgrades, cover unexpected expenses — all with ease and flexibility.

Fully Automated, Fully Simple:

From start to finish, our process is automated and super easy to navigate.

Transparent and Unbiased Advice:

We see people, not just numbers. Get transparent rates, clear terms, and a team that genuinely cares about your success.

Trusted by Media & Industry Experts:

Featured frequently by top Canadian media outlets for our unwavering service.

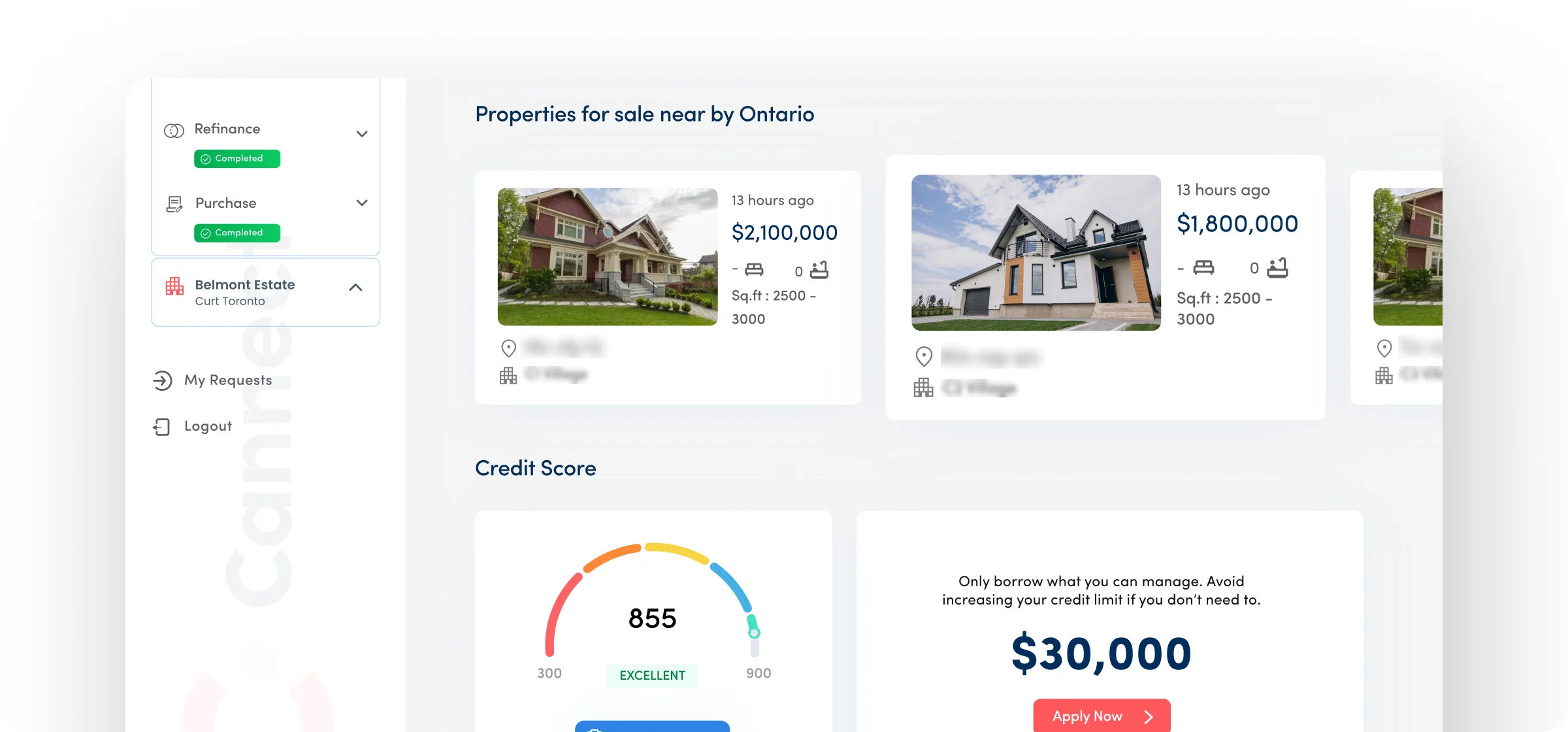

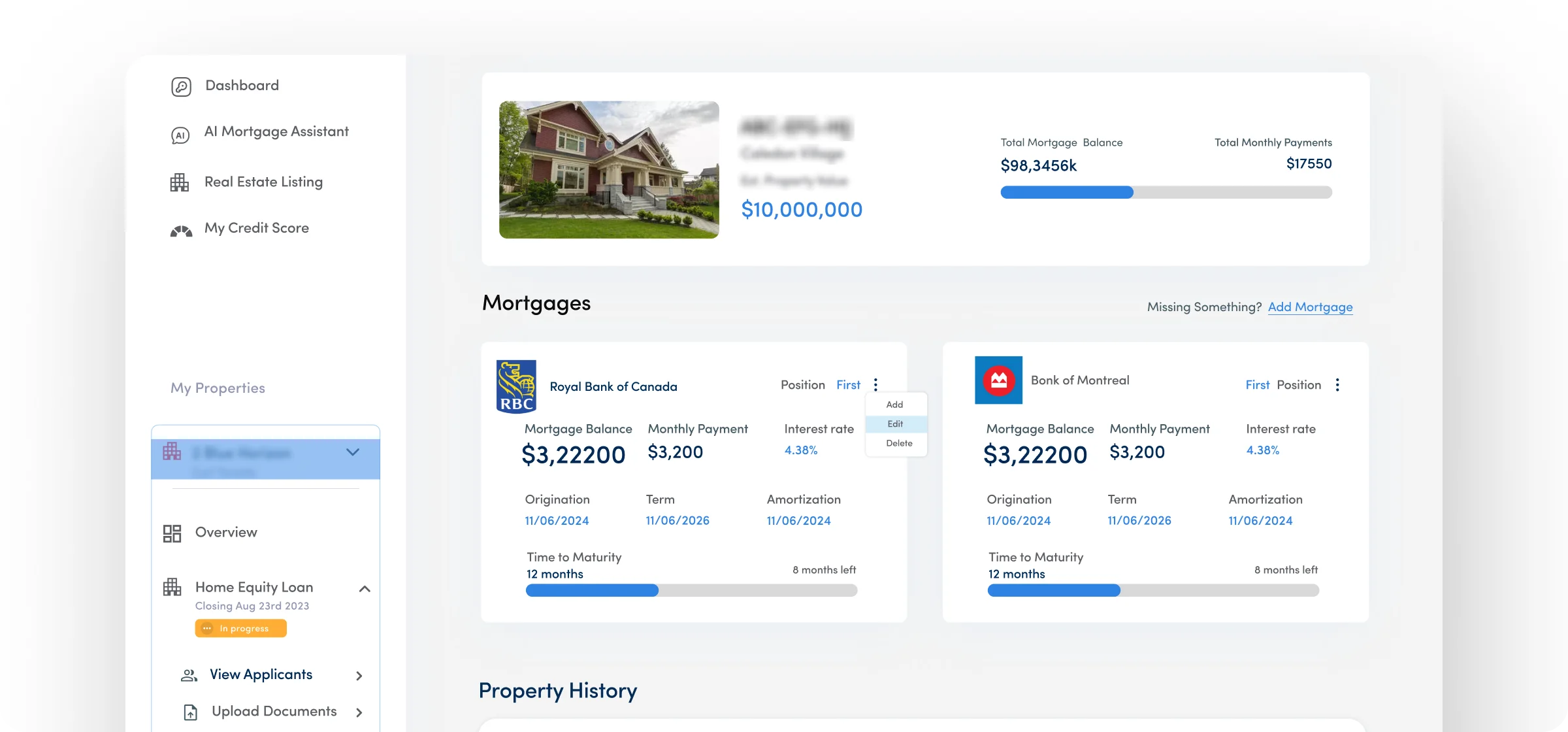

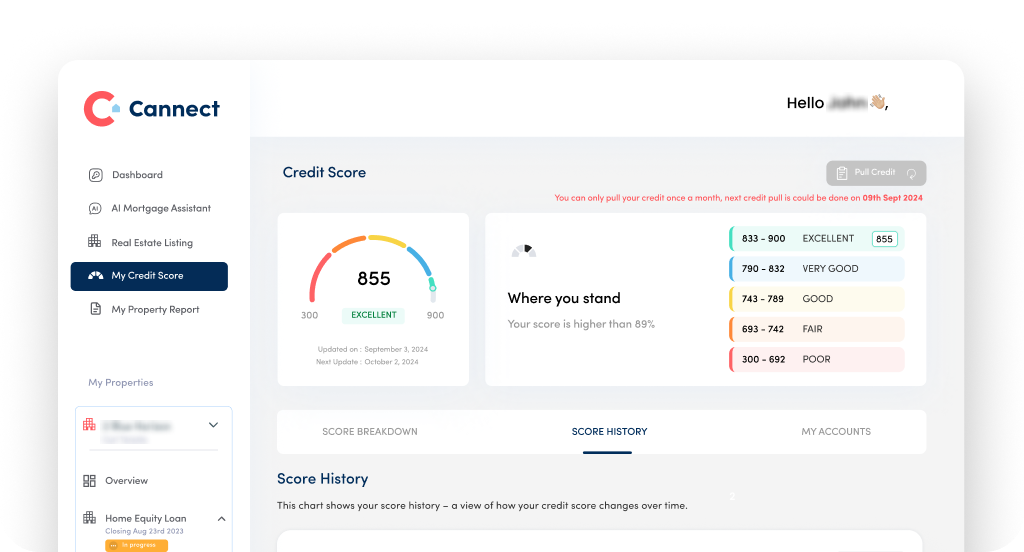

Introducing Our Advanced Borrower Portal: Your Home Equity, at Your Fingertips

Take control of your loan journey with our advanced and exclusive Borrower Portal — the ultimate tool for managing your mortgage and equity effortlessly.

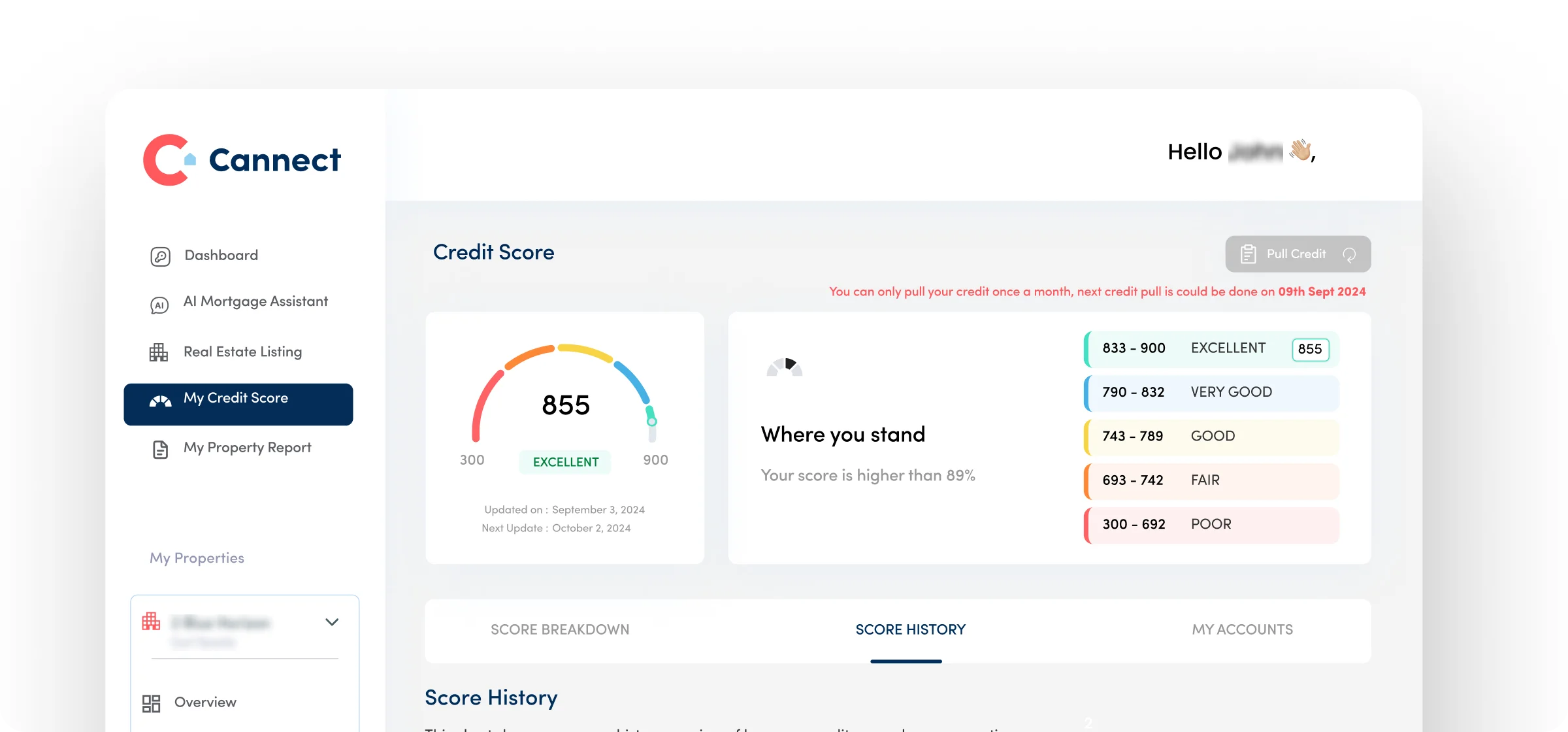

Free Monthly Equifax Credit Report

Stay on top of your credit with free monthly access to your Equifax credit reports delivered straight to you.

Your Personal AI Mortgage Guide

Navigate your loan options with our AI-powered mortgage assistant. Get real-time guidance, answers, and personalized advice.

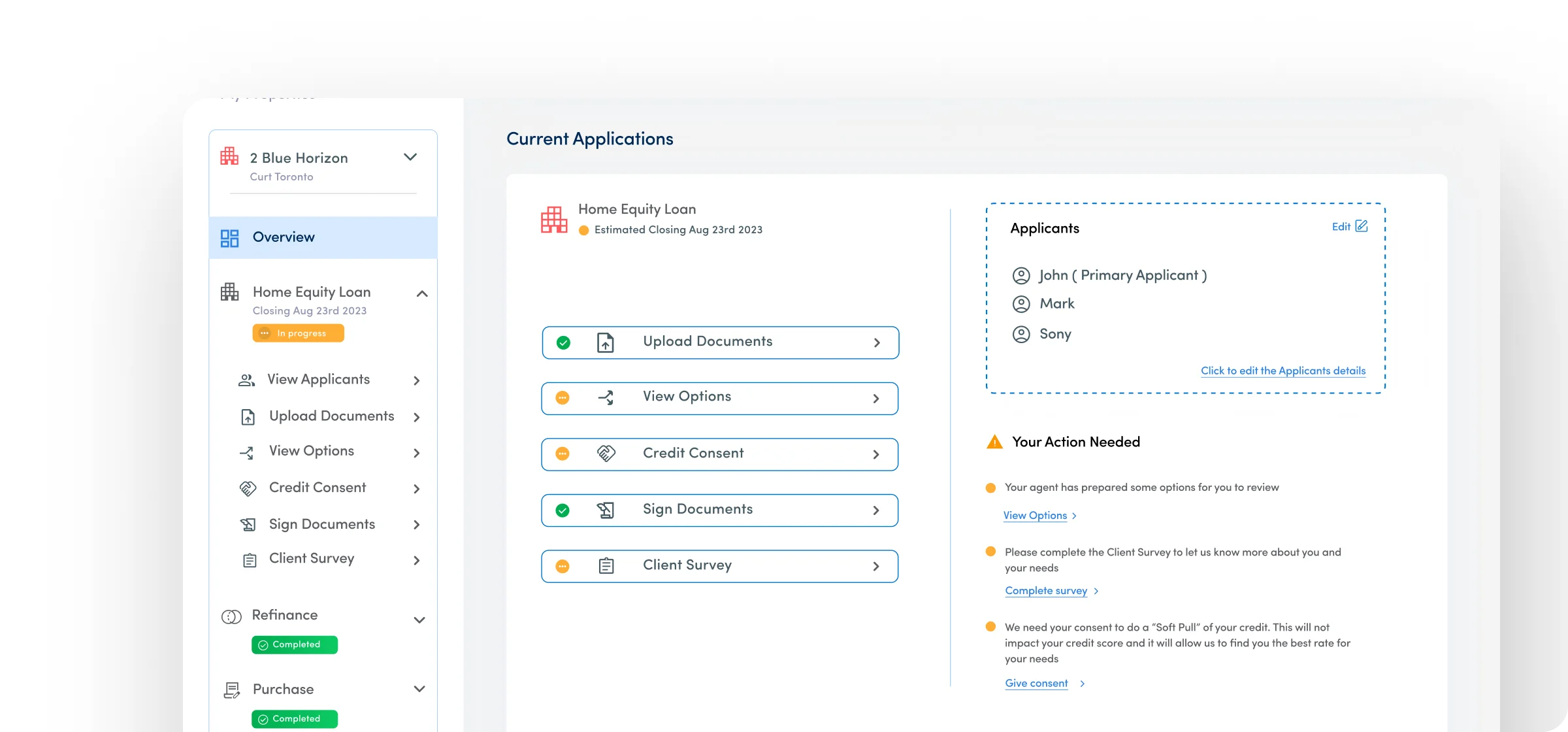

Complete Everything Online

From forms to signatures, do it all online. No paperwork, no hassle. Everything is handled securely online.

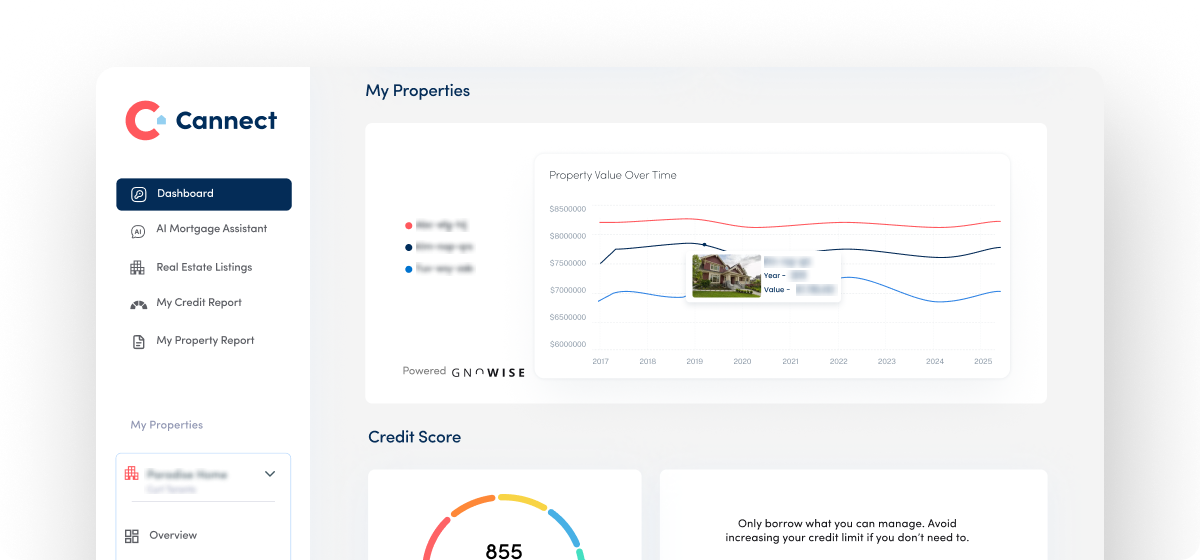

Exclusive Property Value Insights

Get exclusive property value insights at no cost. Understand your home’s worth and stay ahead of market trends.

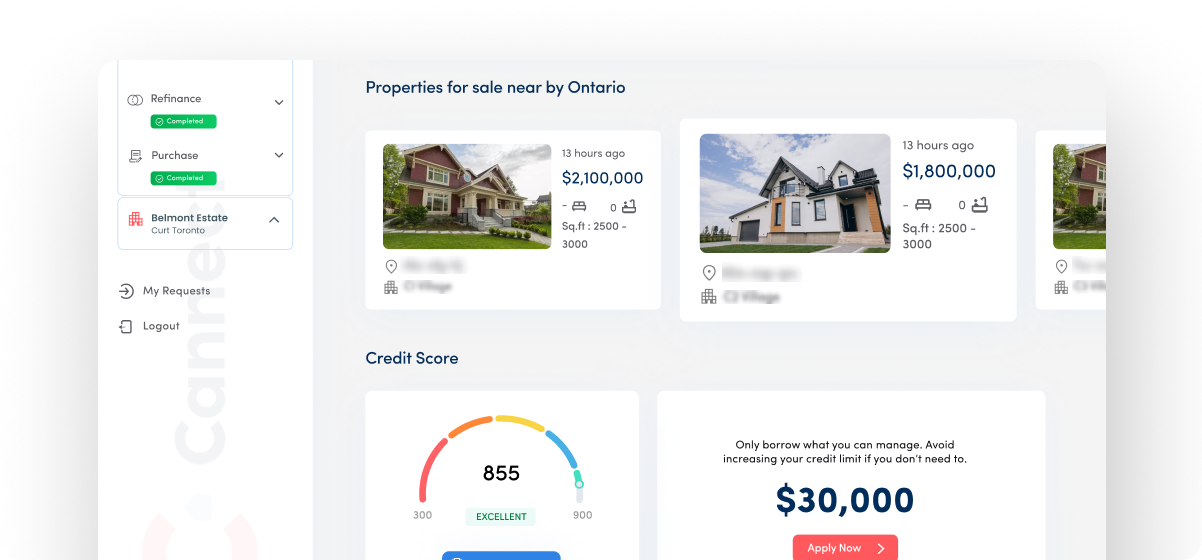

Market Insights: What’s Selling Nearby

Discover nearby property sales to make smarter, data-driven decisions about your equity.

Secure, Simple, and Transparent

Everything you need to manage your loan is right here — accessible anytime, anywhere.

Discover How Cannect Paves Your Path to Financial Freedom

High-Interest Debt Got You Stuck?

We tap into your home equity to offer you your lowest rates. On average 74% of our clients save over $1400/month after only 12 months of working with us

Skip the Bank Delays — Get Fast, Digital Approvals.

Cannect has digitized the loan process for quick approvals. No piles of paperwork, no endless calls — just a simple, user-friendly online application that saves you time and reduces stress.

Hidden Fees? Not with Us.

We keep it real. Our salaried mortgage experts are not chasing commissions, they are chasing the best deal for you.

Expert Solutions Tailored to Your Unique Credit Situation

Your credit score doesn’t define you. Our team of experts excels at resolving your unique scenarios, providing the peace of mind you deserve.

Need Real-Time Loan Information?

Get access to our exclusive Borrower Portal, empowering you with real-time updates and personalized advice to make smarter financial decisions.

Tired of Rigid Loan Terms?

Cannect offers flexible loan terms designed around your financial goals. Whether you need a shorter or longer repayment plan, we give you the freedom to choose what works best for you.

Frequently Asked Questions (FAQs)

1. Why should I choose Cannect for my Home Equity Loan?

Cannect offers competitive rates, personalized service, and a hassle-free process. We work with you to find the best solution for your needs, whether it’s debt consolidation, home improvements, or unexpected expenses.

2. How quickly can I get funds through a Home Equity Loan?

Most approvals happen within 24-48 hours, giving you fast access to the funds you need.

3. Can I use a Home Equity Loan for purposes beyond renovations?

Absolutely! Whether it’s paying off debt, funding education, or handling unexpected expenses, Cannect helps you turn your equity into opportunity.

4. Is an appraisal required for Cannect Home Equity Loans?

Not always. We offer appraisal-free options to save you time, money, and hassle.

5. Are there hidden costs with Cannect loans?

None. At Cannect, transparency is our promise. Every term and fee is upfront — no surprises.

6. Can Cannect help if I’ve been turned down by a bank?

Yes! We specialize in helping homeowners with unique financial situations, including low credit or non-traditional incomes.

Make Money Count Podcast

Our podcast will give you more insight into smart financing

Welcome to the latest episode of Make Money Count! The latest CPI numbers are in, and they’ve got everyone from economists to mortgage brokers talking.

Welcome to the latest episode of Make Money Count! The latest Federal Reserve report just dropped, and it’s raising eyebrows on both sides of the

Welcome to another edition of Make Money Count, where we help Canadians make smarter financial decisions with real-time strategies that work. In today’s episode, we’re